Is Bitcoin Mining Still Profitable in 2025?

Bitcoin mining has long been a focal point for both technology enthusiasts and investors. As of January 31, 2025, with Bitcoin trading at approximately $102,096, many are evaluating the current profitability of mining operations. This article delves deeper into the intricacies of Bitcoin mining, assesses its profitability in 2025, and explores the factors influencing its economic viability.

Understanding Bitcoin Mining

Bitcoin mining is the process by which new bitcoins are introduced into circulation and transactions are verified on the blockchain. Miners utilize specialized hardware to solve complex mathematical puzzles, a mechanism known as Proof of Work (PoW). The first miner to solve the puzzle adds a new block to the blockchain and is rewarded with newly minted bitcoins. This system not only incentivizes miners but also ensures the security and integrity of the decentralized network.

Bitcoin’s profitability is heavily influenced by a few key factors, with Bitcoin halving events playing a central role. Approximately every four years, the network undergoes a halving, cutting the block reward in half. In April 2024, the most recent halving reduced the reward from 6.25 to 3.125 bitcoins per block. This effectively slashes miner earnings while keeping Bitcoin’s supply issuance in check. Historically, halvings have been bullish for Bitcoin's price, as reduced supply often leads to increased demand over time.

However, in the immediate aftermath, many miners struggle with lower rewards, forcing them to optimize operations or upgrade to more efficient mining rigs to maintain profitability.

What Are The Costs of Bitcoin Mining?

One of the biggest costs for miners remains electricity costs. Bitcoin mining is energy-intensive, and profitability often hinges on securing low-cost electricity. While some operations benefit from cheap energy in certain regions, rising global electricity prices have forced many miners to relocate to areas with abundant, renewable energy sources like hydro, wind, or solar power. Some mining farms have even set up in places with excess or stranded energy, allowing them to operate profitably where others might struggle. In contrast, miners in high-cost electricity regions find it increasingly difficult to sustain profitable operations, especially post-halving.

Bitcoin mining in 2025 is more challenging than ever, but it is far from unprofitable. Those who understand the economics behind mining, invest in the right hardware, and secure affordable energy sources still have a significant opportunity to generate returns.

Is Bitcoin Mining Profitable in 2025?

The profitability of Bitcoin mining in 2025 is influenced by the interplay of the factors mentioned above. According to a report by Canaccord Genuity, mining fundamentals are strong, with the cost to mine around $27,000 per bitcoin for larger participants. With Bitcoin's price hovering around $102,096, mining remains profitable for efficient operations. However, smaller or less efficient miners may face challenges due to increased competition and rising operational costs.

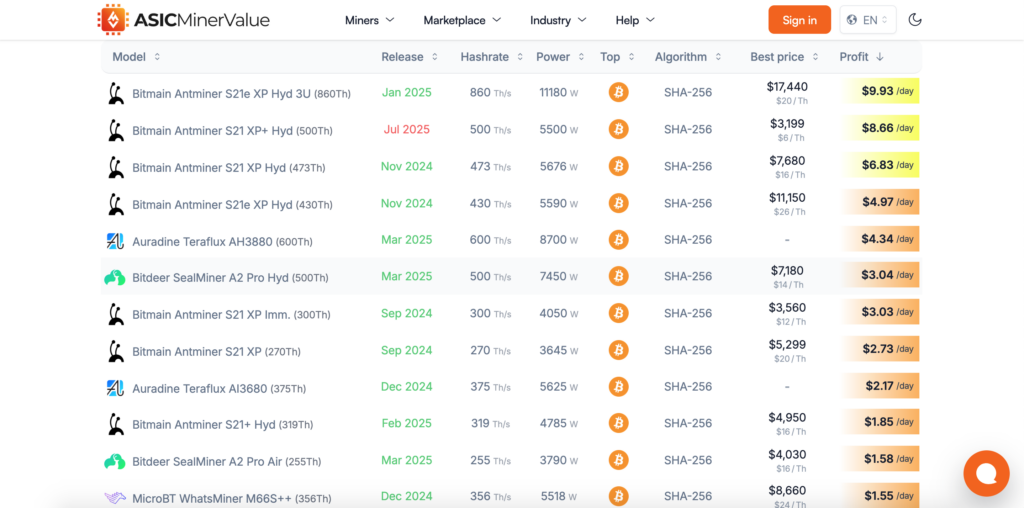

Looking forward into 2025, Mining hardware advancements are another factor shaping the landscape in 2025. The latest generation of ASIC miners offers significant improvements in hash power and energy efficiency compared to older models. Those running outdated rigs often find themselves at a disadvantage, with lower efficiency translating into higher costs per mined bitcoin. Well-capitalized operations that can afford the newest mining technology tend to have an edge, while smaller miners are often forced to join mining pools to stay competitive.

Alternative Cryptocurrencies to Mine

While Bitcoin remains the dominant force in cryptocurrency mining, many miners are turning to alternative cryptocurrencies that offer better profitability, lower competition, or unique advantages. As Bitcoin’s mining difficulty continues to rise and block rewards decrease following the 2024 halving, miners are carefully weighing their options to ensure maximum returns.

Choosing the right cryptocurrency to mine depends on several factors. Market value plays a crucial role, as mining a coin with little demand or liquidity can lead to minimal profits. At the same time, mining difficulty must be considered—coins with lower difficulty allow for easier block rewards, but if the coin lacks strong market interest, miners may struggle to sell their earnings at a desirable price. Additionally, miners must evaluate a project’s long-term potential rather than focusing on short-term profitability. Some cryptocurrencies experience temporary surges in mining profitability but lack sustainability, leading to diminished returns over time.

Ethereum's transition to Proof of Stake (PoS) in 2022 marked a significant shift in the mining landscape, forcing many GPU miners to seek alternatives. Coins like Ravencoin (RVN), Ergo (ERG), and Kaspa (KAS) have since gained popularity among those looking to repurpose their mining rigs for profitable ventures. Meanwhile, Monero (XMR) remains a favorite for privacy-focused miners due to its CPU-friendly mining algorithm, allowing solo miners to remain competitive without the need for specialized hardware.

Final thoughts

Bitcoin mining in 2025 brings a dynamic mix of challenges and opportunities. Although tighter profit margins following the latest halving and growing competition have raised the bar, innovation in mining technology and smart operational strategies still offer a clear path to profitability. For anyone looking to succeed, it's essential to stay focused on factors like hardware efficiency, energy costs, and the ever-changing market landscape. At Empório de criptografia, we stay at the forefront of cryptocurrency developments, helping our community stay informed and ready to adapt. Whether you're a seasoned miner or just getting started, knowledge and flexibility will be your greatest assets in this exciting new era of Bitcoin mining.

Recommended Reading

Kaszinó turné: egy hét alatt tesztelt promóciók tanulságai (esettanulmány)

Kaszinó turné: egy hét alatt tesztelt promóciók tanulságai (esettanulmány) Egy hét alatt, egységes naplózási módszerrel vizsgáltam több promóciót a Legjobb

Nächte voller Klicks: Ein persönlicher Blick auf Online-Casino-Unterhaltung

Was sofort auffällt Der erste Eindruck in einem Online-Casino entscheidet oft darüber, ob man bleibt oder weiterklickt. Viele Plattformen setzen

Nächte voller Glanz: Komfort und klarer Service im Online-Casino

Sofortige Hilfe: Kundenservice im Fokus Ein gutes Online-Casino zeichnet sich durch schnellen und freundlichen Kundenservice aus. Spieler schätzen es, wenn